A Better Mortgage Loan Guide

We understand that refinancing a mortgage can be a bit overwhelming. Fortunately, Orange County's Credit Union's focus is on getting you the best loan possible, as well as the information you need to make smart financial decisions.

Our on-site mortgage consultants work one-on-one with every borrower to find the right loan for each individual situation. We'll work with you to get the best rate available, and always have your best interest in mind. Call (800) 506-5070 to request a no-obligation appointment today.

You have QUESTIONS? We have ANSWERS.

Q. What types of loans does Orange County's Credit Union offer?

We offer up to 30-year fixed-rate loans, ARMs (Adjustable Rate Mortgages), and FHA loans. We also offer a shorter-term loan, Your Last Home Loan, with fixed rates, featuring lower closing costs when compared to longer-term loans. Your Last Home Loan is best for individuals that have a small remaining balance on their current mortgage.

Q. What are the general guidelines to refinance a mortgage or for a new mortgage loan?

Generally, the guidelines are steady employment for the past two years, no foreclosures over the past three years, equity of at least 5% (if refinancing), the ability to make payments, and money for a down payment (if new purchase). Providing this information, however, does not guarantee eligibility; each situation is reviewed individually.

Q. What does it mean to refinance?

It simply means that you're trading in one loan including the rate and features for an entirely new loan. You'll use the new loan to payoff the old loan. Since you're getting a new loan, you'll need to qualify for the new loan which means a new application and closing process. Our mortgage consultants will explain the process and answer your questions, so you understand your options before you move forward.

Q. Is it a good time to refinance? Are rates still low?

Yes, rates are still considered at record lows. Don't wait to contact us because rates can change daily. We offer a complimentary 30-day rate lock after you're pre-approved.

Q. What's my home worth?

There are many Web sites, such as Zillow.com, which provide free estimates about home value. These estimates only give you a general idea about home value. Our mortgage consultants will help coordinate a professional appraisal when you refinance or buy a new home to determine the most accurate value.

Q. Is refinancing worth my time?

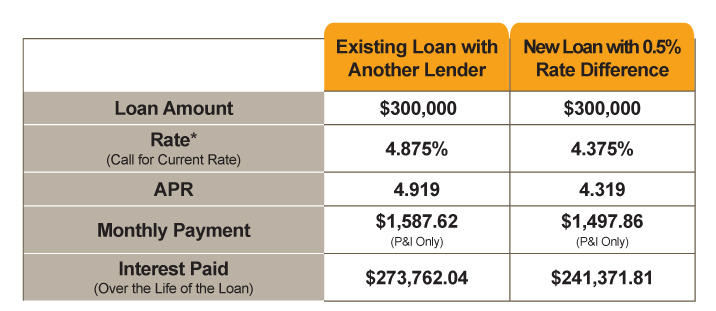

Refinancing can be an important option to consider because your current interest rate could be higher than today's low rates. Generally, if there's a 0.5% interest rate difference you could save money. Our mortgage consultants can review your current loan for no cost, no obligation to see if there's an opportunity to save you money.

Example: 0.5% Interest Rate Difference

This example is based on an owner-occupied, single-family residence, no-cash out, conventional loan at 30 years. FICO score 740 and above, CLTV not to exceed 70%. 0 points. Monthly Payment includes principal and interest only. Interest rate is fixed for 30 years. Rates as of 7/11/14. Rates subject to change at any time.

Meet our Mortgage Consultants

Jerry Baez |

Nancy Marcosa |

Valentina Orlov |

Ginny Castorena |

Jennie Amick |

Apply Today!

Apply online or call a Mortgage Consultant (800) 506-5070. ![]()

|

Lock in a low payment, then pay extra. The security of a low mortgage payment and paying a little extra can reduce your debt more quickly. And, you'll save a bundle in interest. |

Related Links

> Featured Rates

> Mortgage Stories

> Featured Articles

> What's my home worth?

> How much equity

do I need to refinance

my home?

> Get a copy of your

credit report