Understanding Credit Scores

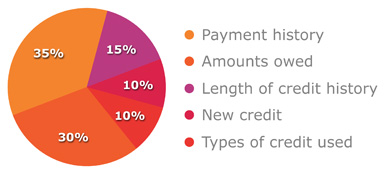

Credit scores are determined by many different types of information in your credit history. The Fair Isaac Corporation, developers of the FICO® score software used by the major credit bureaus, groups credit information into five categories.

Source: www.myfico.com

Note: not all categories are equal. For instance, your Outstanding Debt counts for 30% of your score, while the Credit History Length is worth only 15%.

What Does This All Mean?

Here's a brief explanation of each category that makes up your credit score:

|

Payment History - This looks at your record of making your payments on time. Other factors include how many late payments, the severity (i.e 30 days late vs. 90 days late), and how long ago. This category also searches for adverse public records (i.e. bankruptcy, liens, wage garnishments, etc.).

Outstanding Debt - This is a review of how much money you currently owe lenders. It measures not only the actual dollars owed, but how many accounts with open balances you have, as well as how "maxed out" you may be. Length of Credit History - This calculates how long you've had credit accounts. In this category, longer is definitely better. The last time you used credit is also reviewed. Recent Credit - This determines whether your credit accounts are new or old. Too many recently opened accounts can drive a score down. This also measure recent credit inquiries. Types of Credit - The different types of accounts you have are analyzed in this category. |

Keep in mind that although each credit score utilizes information from all five categories, each credit history is calculated uniquely. The percentage breakdown of each category is a general rule, but may be different from one individual to the next. It's impossible to predict how much weight to give any one given factor of your history. Your best bet is to display positive credit behavior over time.